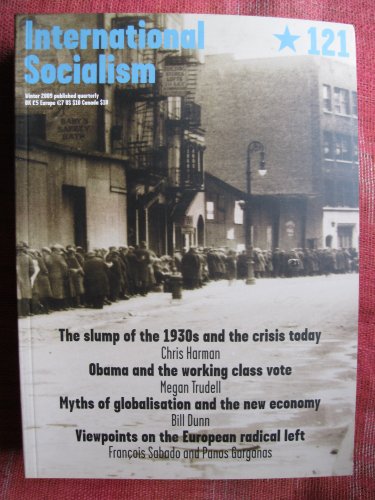

International Socialism 121 Winter 2009 The Slump of the 1930s and the Crisis Today

Summary

“We are on the edge of the abyss. One slip and we will be into depression like that of the early 1930s.” That message has been repeated a thousand times in one way or another since the banking system imploded and stock markets sank in September and October 2008. However, there has been very little real analysis of what produced the great slump or of the real comparisons with the situation today. The slump of the 1930s was by far the worst that capitalism had ever known. It cut industrial output by half in the world’s two biggest economies, the US and Germany, and made about a third of workers unemployed in each case. It was by far the most significant economic event of the 20th century. Yet coming to terms with the slump has been the great problem of mainstream economics. Ben Bernanke, head of the US federal reserve bank, is meant to be one of the mainstream experts on it. He calls the explanation the “Holy Grail” of economics1—something sought after but never found. Nobel economics laureate Edward C Prescott describes it as a “pathological episode and it defies explanation by standard economics”.2 For Robert Lucas, another Nobel laureate, “it takes a real effort of will to admit you don’t know what the hell is going on”.3